Financial infrastructure for creators — built for brand deals

Creatapay is a creator-native accounting platform that helps professional creators manage brand deals, pricing, invoices, payments, and earnings — all in one clean dashboard.

Built and tested with early creators managing real brand deals, invoices, and payments.

£160B+

Creator Economy Today

£800B+

Projected by 2035

0

Dominant Finance Layer

Investment Thesis

Creators are now businesses. They need business-grade financial tools.

Different Income Structure

Creator income is fundamentally different from traditional employment. It's deal-based, not salary-based. Multi-stream, not single-source. Irregular, not predictable.

Existing Tools Don't Fit

Traditional accounting software was built for invoices and expenses — not brand deals, deliverables, usage rights, and exclusivity clauses. Creators are forced into spreadsheets.

High Pain, Weekly Frequency

Professional creators manage multiple brand deals simultaneously. They invoice weekly, chase payments constantly, and struggle to price their work accurately.

System of Record Opportunity

Creatapay is positioned to become the financial system of record for creators — the place where all deal data, invoices, payments, and earnings live.

“Creatapay is building the financial infrastructure layer that professional creators need but don't have. The market is large, the pain is real, and there is no dominant player.”

Market Opportunity

A large, growing market with no dominant financial infrastructure

The creator economy represents one of the largest shifts in how work and income are structured — yet financial tooling has not caught up.

£160B+

Creator Economy Today

Estimated global value

£800B–1T+

Projected Next Decade

Conservative estimates

Millions

Professional Creators

Earning meaningful income

Why This Is a Vertical SaaS Opportunity

Large addressable market — tens of millions of creators globally, with the professional segment growing fastest.

High pain intensity — financial admin is a weekly burden, not an annual chore.

No dominant solution — existing tools are generic, not creator-native.

Market Dynamics Favouring Creatapay

Brand advertising spend continues shifting toward creators, increasing deal volume and operational complexity.

Creators are professionalising — treating content as a business, not a hobby.

Tax and compliance expectations are rising — creators need clean records.

The Problem

Creator finances are broken

Professional creators face the same financial chaos every week. The tools they need simply don't exist.

Deals Scattered Everywhere

Brand conversations lost across emails, Instagram DMs, WhatsApp, and multiple platforms. No single source of truth.

Constant Payment Chasing

Hours wasted following up on money already owed. Payment delays are common, and visibility into what's paid vs. unpaid is poor.

Pricing Uncertainty

Creators guess at rates and consistently leave money on the table. No structured logic for deliverables, usage, or exclusivity.

Manual Invoicing

Creating invoices is tedious. Tracking which have been sent, viewed, or paid requires constant mental overhead.

Reactive Tax Prep

Messy records lead to stress, unexpected tax bills, and scrambling at year-end. Creators must manage quarterly obligations and tax payments.

Spreadsheets as Default

The current stack is spreadsheets + inboxes + memory. Manual, fragile, and fundamentally non-scalable.

Timing

Why now?

Several converging trends make this the right moment to build creator financial infrastructure.

Creator Professionalisation

Content creation is no longer a side hustle. Creators are building real businesses, hiring teams, and treating income with the seriousness it deserves. They need professional-grade tools.

Increased Deal Volume

Professional creators now manage 10–50+ brand deals per year. Each deal requires tracking, invoicing, and payment follow-up. The operational load has crossed a threshold.

Rising Compliance Expectations

Tax authorities expect accurate records. Creators must manage quarterly obligations and payments on account. Clean financial data is no longer optional.

Infrastructure Maturity

SaaS and fintech infrastructure has matured. Building vertical financial tools is now faster, cheaper, and more reliable than ever before.

The Solution

What Creatapay does today

A complete system for managing brand deal finances — from initial conversation to final payment.

Deal Tracker

Pipeline view with status tracking, due dates, and automatic reminders. Every brand deal in one place.

Invoice Generator

Create professional PDF invoices and send directly to brands. Track sent, viewed, and paid status.

Rate Calculator

Get data-backed pricing based on deliverables, usage rights, and exclusivity terms.

Payment Tracker

See what's due, what's overdue, and what's been paid. Never lose track of money owed.

Contract Vault

Upload, tag, and organise all brand agreements. Link contracts to deals for complete visibility.

Brand Directory

Keep contacts and notes for every brand you work with. Build your relationship history.

Earnings Insights

Monthly breakdowns and income trends at a glance. Understand your business performance.

Tax-Ready Export

Download CSV reports ready for your accountant. Clean data, no manual formatting required.

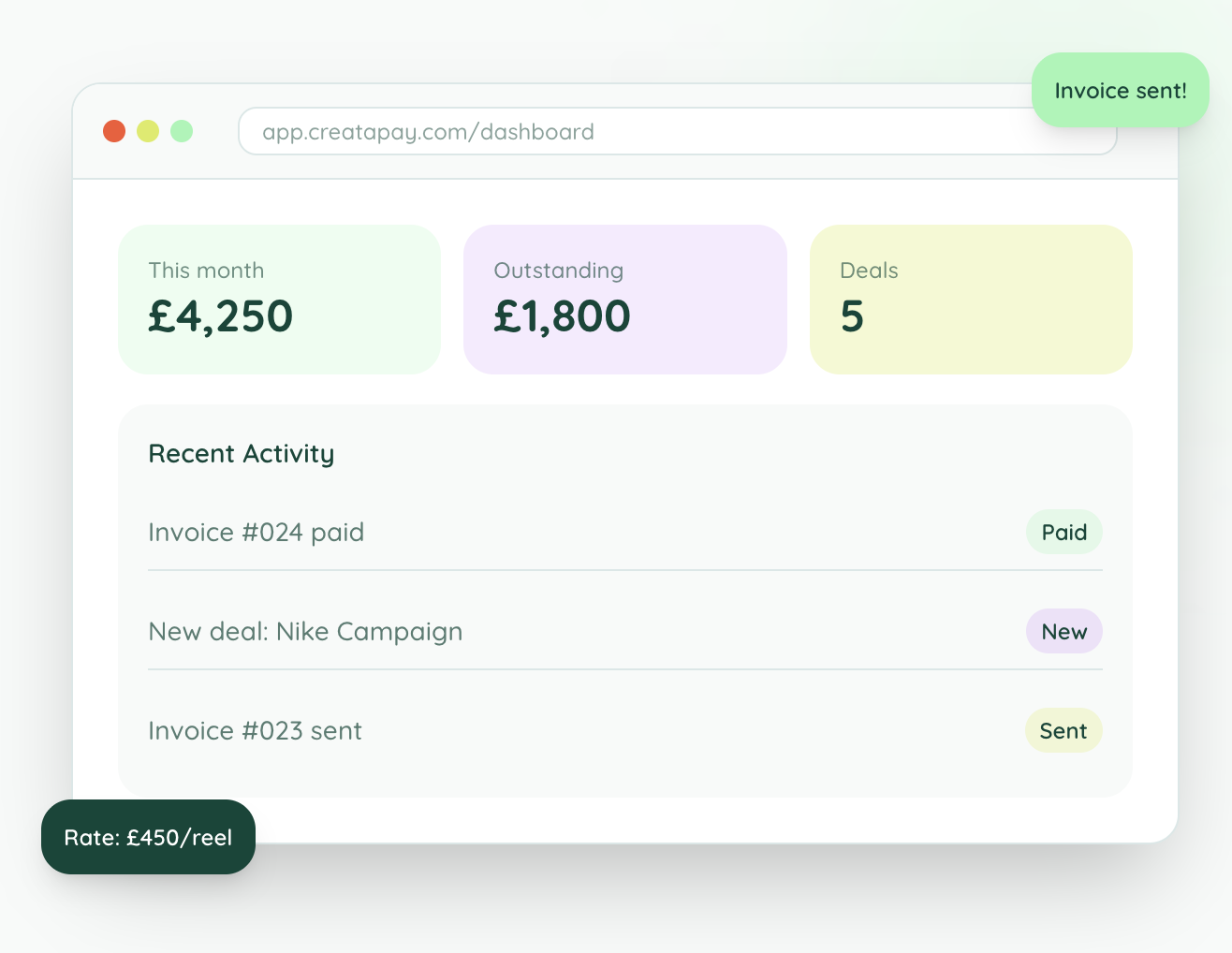

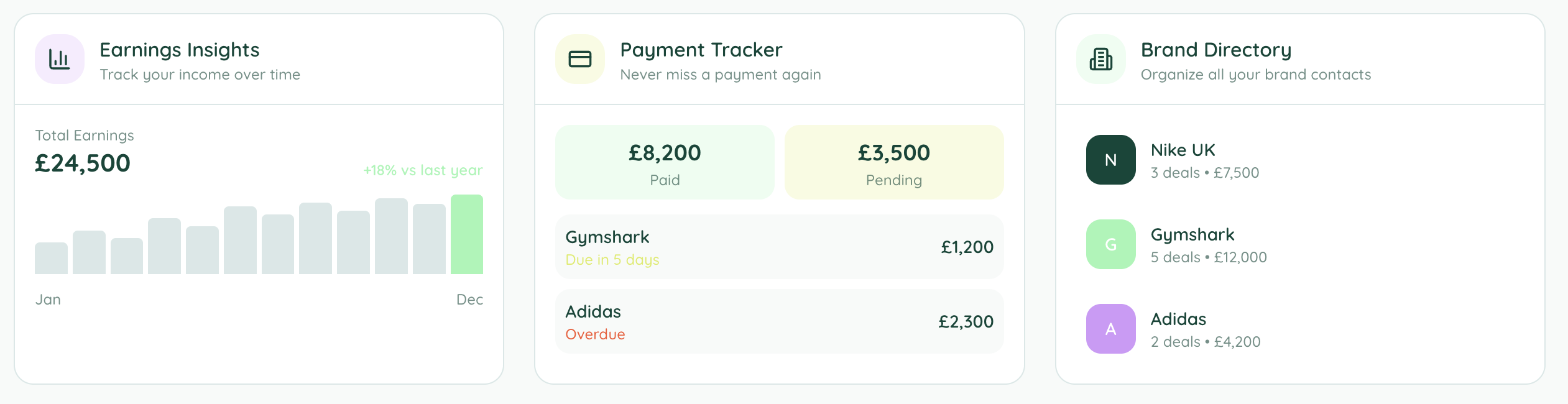

Product Snapshots

See it in action

Real product interfaces showing how creators manage their entire business—from rate calculations to payment tracking—all in one place.

Core Features: Track earnings, monitor payments, and organize brand relationships at a glance

Dashboard: Real-time metrics, activity feed, and integrated rate calculator built for creators

Advanced Tools: Professional invoicing, data-backed pricing, and AI-powered contract analysis

Screenshots taken from the live Creatapay platform (anonymised).

Built for creators who want to professionalise their business. Get early access today.

Try It NowPositioning

What Creatapay is — and isn't

Clear boundaries define our focus and ensure we build something excellent, not something bloated.

What Creatapay Is

- A creator-native accounting and finance platform

- A system of record for brand deal income

- A tool for tracking deals, invoices, and payments

- A provider of clean, exportable financial data

- A subscription SaaS business

What Creatapay Is Not

- Not a bank or financial institution

- Not a tax filing service or tax advisor

- Not a lending or credit provider

- Not a marketplace or deal-sourcing platform

- Not a payment processor (today)

Target User

Ideal Customer Profile

We are building for professional creators who feel financial pain weekly, not annually.

Primary ICP

- •Professional creators earning consistent income from brand deals

- •Active on Instagram, YouTube, and/or TikTok

- •Solo creators or small teams (1–5 people)

- •Managing 10+ brand deals per year

Secondary ICP

- •Talent managers handling multiple creators

- •Small creator agencies (5–20 creators)

- •Need consolidated view across roster

- •Higher willingness to pay for team features

Not Our Target

- •Hobby creators with occasional income

- •Creators earning primarily from platforms (AdSense, etc.)

- •General freelancers without brand deals

- •Users seeking tax filing or banking services

Competition

Competitive Landscape

Existing solutions address fragments of the problem. None provide the complete, creator-native financial system that professional creators need.

| Feature | Creatapay | Xero / QuickBooks | Payment Tools | Deal Platforms | Spreadsheets |

|---|---|---|---|---|---|

| Deal Tracking | |||||

| Invoice Creation | |||||

| Payment Tracking | |||||

| Rate Calculator | |||||

| Contract Storage | |||||

| Earnings Insights | |||||

| Tax-Ready Export | |||||

| Creator-Native UX |

Creators default to spreadsheets and generic tools because none treat brand deals as first-class financial objects.

Traditional Accounting (Xero, QuickBooks)

Powerful general-purpose tools, but not creator-native. They lack deal pipelines, deliverables tracking, and rate logic. Creators must adapt their workflow to fit software designed for traditional businesses.

Payment Tools

Solve payout speed but don't provide financial structure or planning. Creators still need to track deals, calculate rates, and maintain records elsewhere.

Deal Platforms

Help source brand partnerships but are not financial systems of record. Once a deal is sourced, creators are left to manage everything else manually.

Spreadsheets

The current default. Manual, error-prone, and fundamentally non-scalable. Requires constant maintenance and provides no automation or insights.

Business Model

Pricing & Unit Economics

Simple subscription SaaS with pricing aligned to accounting software benchmarks.

Free

Perfect for getting started

- Deal tracking basics

- 3 invoices/month

- Rate calculator

Creator Pro

For serious creators

- Unlimited deals

- Unlimited invoices

- Rate calculator + benchmarks

- Earnings insights

- Contract vault

- Brand directory

- Priority support

Team

For talent managers

- Everything in Pro

- Multi-creator management

- Team permissions

- Shared brand directory

- Advanced reporting

- API access

- Dedicated support

Why Monthly Works

Deal tracking and payment follow-up are ongoing activities. Creators return weekly, not just at tax season.

ARPU Growth Path

As creators scale, they upgrade to Pro. As they build teams, they move to Team tier. Natural expansion revenue.

Competitive Positioning

Priced below traditional accounting software while delivering more value for the creator use case.

Retention Logic

Why creators keep coming back

Creatapay is not designed as a once-a-year finance tool. Its core workflows are built around the ongoing deal lifecycle, which creates habitual usage over time.

Deal Lifecycle Drives Usage

Each brand deal has multiple touchpoints: initial logging, rate calculation, invoice creation, payment tracking, and closure. Creators return at every stage.

Time-Sensitive Actions

Invoices must be sent. Payments must be chased. Due dates create urgency. This is active software — not passive.

Earnings Insights Year-Round

Creators check earnings monthly, not just at tax time. Understanding income trends helps them plan, negotiate, and make business decisions.

Compounding Value

The longer a creator uses Creatapay, the more valuable it becomes. Historical data, brand relationships, and rate benchmarks accumulate over time.

Financial Model

Illustrative Financial Scenarios

Based on subscription SaaS economics with conservative assumptions.

Retention Logic

Why creators keep coming back

Creatapay is not a tool you use once a year. The deal lifecycle creates ongoing, habitual usage.

•Weekly usage driven by active deal pipelines and invoice tracking

•Time-sensitive workflows (payments due, overdue invoices) create habit

•Earnings insights and exports support year-round engagement, not just tax season

Key Assumptions

- Blended ARPU£20–£35/month

- Gross Margin80–90%

- Model TypeSaaS Subscription

Margin Drivers

- •Low infrastructure costs (standard SaaS stack)

- •No payment processing liability (today)

- •Self-serve onboarding reduces support load

- •Product-led growth potential

| Scenario | Users | ARPU | ARR |

|---|---|---|---|

| Early Stage | 5,000 | ~£20 | ~£1.2M |

| Growth | 25,000 | ~£30 | ~£9.0M |

| Scale | 100,000 | ~£35 | ~£42.0M |

Illustrative scenarios only. Not projections or forecasts.

These scenarios are deliberately conservative and assume subscription revenue only — no payments, lending, or marketplace expansion.

Roadmap

Product Evolution

A disciplined roadmap focused on deepening core value before expanding scope.

Near-Term

Next 6–12 months

- •Deeper workflow automation

- •Improved forecasting clarity

- •Enhanced deal tracking features

- •Mobile experience improvements

Medium-Term

12–24 months

- •AI-assisted rate recommendations

- •Smarter earnings insights

- •Advanced reporting suite

- •Team collaboration features

AI features are designed to surface insights and recommendations, not to automate financial decisions.

Long-Term

24+ months

- •Creator finance intelligence platform

- •Anonymised benchmarks

- •Accounting integrations

- •Banking partnerships (TBD)

Use of Funds

Investment Priorities

Focused allocation to accelerate product development and creator acquisition.

Engineering

Hire 1 senior developer to increase product velocity and code quality. Focus on core platform stability and feature development.

Creator Acquisition

Targeted marketing to professional creators. Content marketing, creator partnerships, and community building.

User Feedback

Tight feedback loops with early users. Continuous iteration based on real creator workflows and pain points.

Investment Timeline

Developer hire and onboarding

Workflow automation and forecasting improvements

Creator acquisition experiments and retention optimisation

Discipline

What we are not doing yet

Focus is a competitive advantage. We're deliberate about what we don't build.

No Banking

We are not a bank. We do not hold funds, issue cards, or provide banking services.

No Tax Filing

We do not file taxes or provide tax advice. We provide clean data for accountants.

No Lending

We do not provide loans, advances, or any form of credit. No regulated lending activity.

No Regulated Products

We deliberately avoid any regulated financial products that require licensing.

No Premature Expansion

We are UK-first but welcome international users from the US and Australia. We will expand officially once our core market is proven.

No Payment Processing

We do not process payments directly (today). Creators receive payment from brands through existing channels.

The Ask

We're raising pre-seed / seed

Building the financial infrastructure layer for the creator economy. We're looking for investors who understand vertical SaaS and believe in the professionalisation of creators.

Interested in product, partnerships, or investment conversations.

Technical Appendix

Architecture & Technical Details

Comprehensive technical documentation for diligence purposes.